Meal Prep for Savings

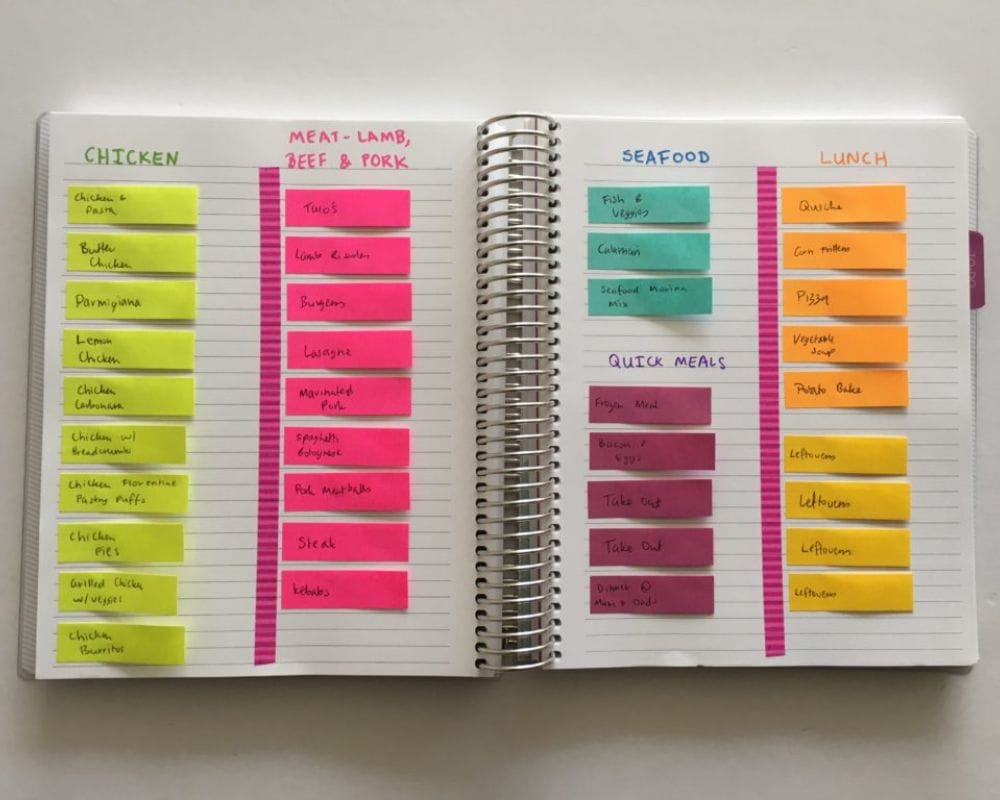

Meal prepping is a delicious way to save both time and money! Dedicating a few hours each week to preparing meals in advance ensures healthy, home-cooked options are always at your fingertips. This approach minimizes the temptation to order takeout on busy nights, effectively keeping your grocery budget in check.

Start by planning meals with everyday ingredients, reducing waste, and maximizing efficiency. You’ll also save on grocery trips and enjoy more free time during the week. Embrace meal prep, and watch your savings grow alongside your culinary skills.

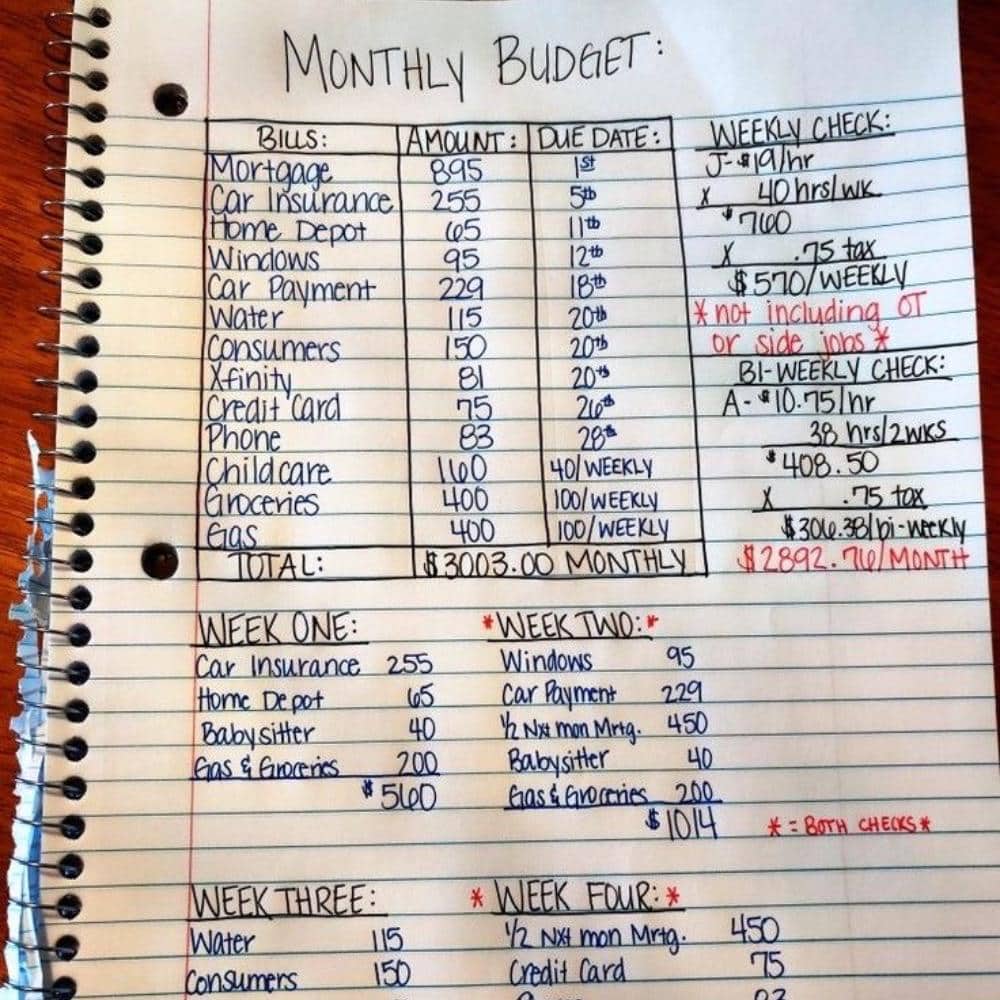

Budgeting Made Easy

Budgeting doesn’t have to feel overwhelming; it’s your roadmap to financial freedom. Begin by tracking your income and expenses, using simple apps or spreadsheets to categorize spending. Identify areas where you can cut back — maybe those daily coffee runs could be swapped for brewing at home?

Set specific financial goals, whether saving for a vacation or paying off debt. Review your budget monthly to see how you’re doing, making adjustments as needed. With a solid budget, you’ll gain control over your finances and pave the way to a brighter financial future.

Automate Your Savings

Automating your savings can be a game-changer for your financial health! By setting up automatic transfers from your checking account to a savings account, you’ll effortlessly save money without thinking about it. Consider using a high-yield savings account to maximize your interest earnings over time.

This technique helps prevent the temptation to spend what you should be saving. Treat your savings like a monthly bill that must be paid, and you’ll build your financial cushion in no time. Watch your savings grow effortlessly while you focus on living your life.

Smart Grocery Shopping Tips

Shopping smartly can lead to significant savings at the grocery store. Start by creating a detailed shopping list based on meal plans, which helps you avoid impulse purchases and stick to your budget. Don’t forget to check store flyers for weekly deals and coupons.

Buying non-perishable items in bulk can also yield great savings, as can choosing store brands over name brands. Utilize apps that compare prices across different stores to find the best deals. With these tips, grocery shopping can become a budget-friendly adventure rather than a financial burden.

Cutting Utility Costs Fast

Reducing your utility bills doesn’t require a complete lifestyle overhaul! Start by evaluating your energy consumption habits — turning off lights when not in use and unplugging electronics can make a difference. Consider investing in energy-efficient appliances to decrease costs over time further.

Another quick win is adjusting your thermostat. Lowering it by just a couple of degrees in winter or raising it in summer can lead to substantial savings. With these easy adjustments, you’ll notice your utility bills shrink without sacrificing comfort.

Thrifty Home Décor Ideas

Transforming your space doesn’t have to break the bank. Thrifty home décor ideas can turn any room into a stylish sanctuary without hefty price tags. Start by browsing thrift stores or garage sales for unique finds, like vintage furniture or art pieces that add character to your home.

DIY projects can also elevate your décor at minimal cost. Upcycle old furniture with fresh paint or repurpose items into trendy home accents. With a little creativity and resourcefulness, you can create a stunning living space that reflects your style while saving money.

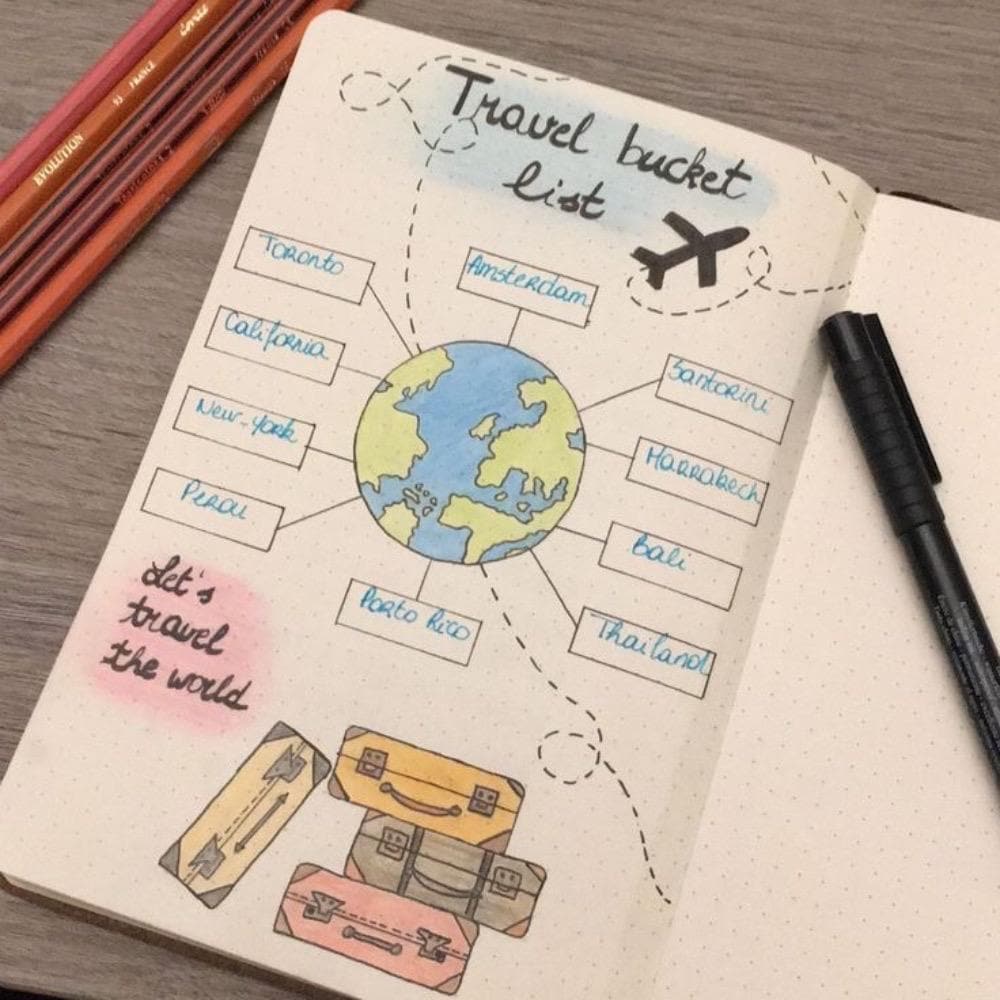

Travel on a Budget

Exploring the world doesn’t have to come with a hefty price tag! Traveling on a budget requires strategic planning, starting with flexible travel dates. Use fare comparison websites to snag the best flight deals, and consider alternative airports or nearby cities to save even more.

Accommodation can also be affordable; look into hostels, vacation rentals, or even house swapping. Don’t forget to explore free or low-cost activities at your destination. With these tips, you can enjoy enriching travel experiences without emptying your wallet.

DIY Home Repairs

DIY home repairs can save you a bundle of maintenance costs. With a little research and the right tools, you can tackle simple tasks like fixing leaky faucets or patching drywall. Online tutorials and videos provide step-by-step guidance, making it easier than ever to learn new skills.

Before you start any project, assess your abilities honestly — if it feels too complex, calling a professional might still be the best route. However, embracing DIY for minor repairs can empower you, boost your confidence, and significantly reduce home upkeep expenses.

Maximize Your Tax Refund

Maximizing your tax refund is all about preparation and strategy! Start by gathering all necessary documents early, such as W-2s and 1099s, to ensure a smooth filing process. Explore deductions and credits you may qualify for, like education or home office expenses, to boost your refund.

Consider investing your refund wisely, whether in paying down debt, building an emergency fund, or making strategic purchases. By approaching tax season with intention, you can turn that refund into a valuable opportunity for financial growth.

Easy Decluttering Techniques

Decluttering your space can feel liberating and financially savvy. Start small by focusing on one area, like a closet or a drawer. Use the “one in, one out” rule — when you bring in something new, let go of something old. This helps maintain a clutter-free environment.

Consider hosting a garage sale or donating items you no longer need. Not only does this free up space, but it can also earn you a bit of cash or provide a tax deduction. Easy decluttering techniques will create a more organized, stress-free home.

Negotiate Your Bills

Negotiating your bills can lead to substantial savings. Many service providers, from cable to insurance, may be willing to lower your rates if you simply ask. Start by researching competitors to know what similar services cost, which gives you leverage during negotiations.

Be polite but firm when you call — explain your situation and express your desire for better rates. You might be surprised at how often companies will work with you. With a little effort, you can trim your monthly expenses significantly, freeing up cash for other priorities.

Quick Fixes for Appliances

When appliances act up, quick fixes can save you from costly repairs. Start by consulting the user manual or searching online for troubleshooting tips for your issue. Often, simple problems can be resolved by checking plugs, resetting breakers, or cleaning filters.

If the issue persists, consider whether a DIY repair is feasible. Many common appliance problems have straightforward solutions. Learning to fix small issues can extend the life of your appliances and save you money on unnecessary replacements.

Batch Cooking Benefits

Batch cooking is a savvy way to save both time and money. By preparing large portions of meals in advance, you’ll have ready-to-eat options for busy days, reducing the temptation to order takeout. This practice not only saves you money but also encourages healthier eating habits.

Choose versatile recipes that can be easily frozen or stored, such as soups, casseroles, or grains. Portion out meals into containers for grab-and-go convenience. With batch cooking, you’ll enjoy the satisfaction of home-cooked meals without the daily hassle of cooking.

Energy-Efficient Living Tips

Embracing energy-efficient living can significantly reduce your utility bills and your environmental impact. Start by replacing incandescent bulbs with LED lights, which consume less energy and last longer. Consider using smart power strips to eliminate phantom energy use from electronics.

Other simple changes include insulating your home to keep heating and cooling costs down and using energy-efficient appliances. By implementing these tips, you can create a more sustainable lifestyle while saving money without sacrificing comfort or convenience.

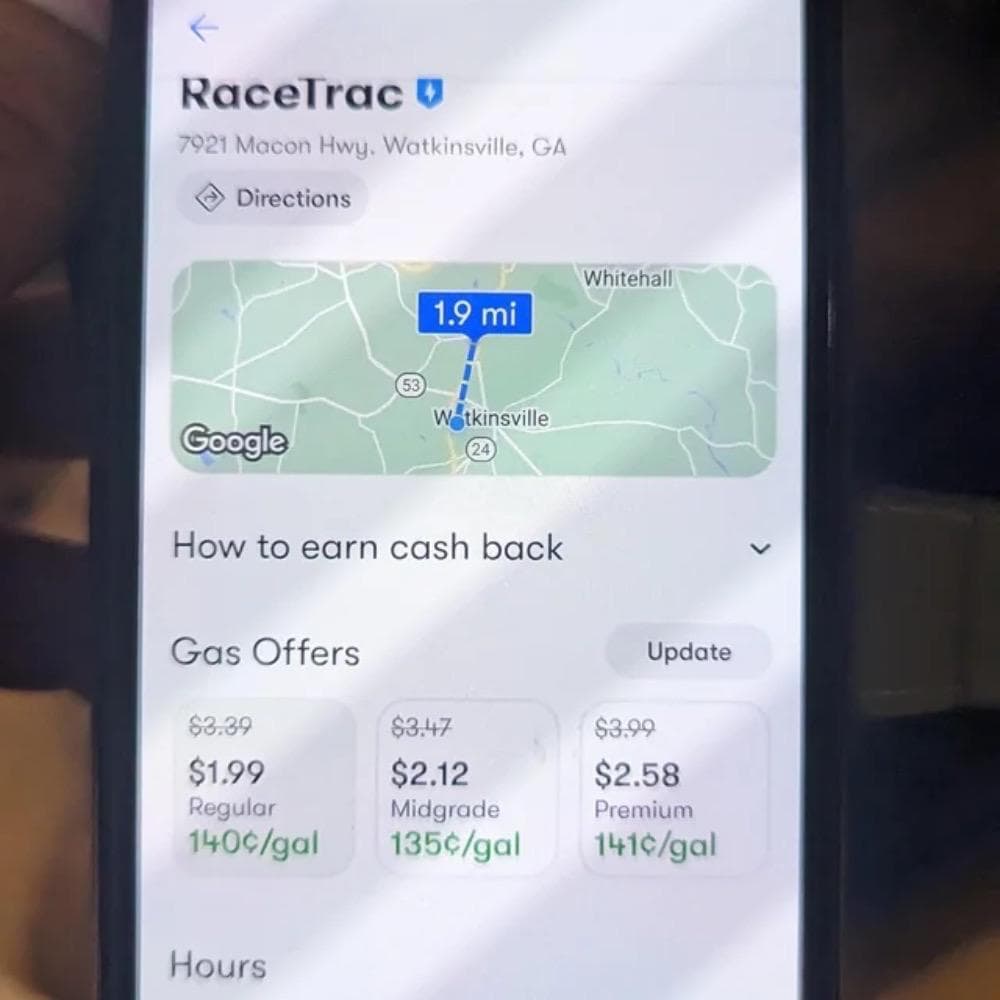

Cash-Back Apps Review

Cash-back apps are a savvy shopper’s best friend! These apps allow you to earn money back on everyday purchases, whether groceries, clothing, or dining out. Popular options include Rakuten and Ibotta, which offer cash-back deals at various retailers.

To maximize savings, check app offers before shopping and upload receipts for qualifying purchases. You can turn routine spending into extra cash in your pocket with minimal effort. Embrace these digital tools and watch your savings grow effortlessly.

Creating a Capsule Wardrobe

A capsule wardrobe simplifies your style and saves you money. This concept involves curating a small collection of versatile clothing pieces that can be mixed and matched for various occasions. Start by evaluating your closet — keep items you love and wear regularly while donating or selling the rest.

Focus on quality over quantity, investing in timeless staples that won’t go out of style. With a capsule wardrobe, you’ll reduce clutter, streamline your mornings, and discover your unique style without the burden of excessive clothing.

Strategic Couponing Hacks

Couponing can be an art form, and strategic hacks can elevate your savings game! Start by organizing your coupons into categories, making it easy to find what you need while shopping. Combine manufacturer coupons with store sales for maximum discounts.

Consider using apps that digitalize coupons, tracking your savings effortlessly. Also, take advantage of double or triple coupon days at local stores. With a little strategy and creativity, you’ll transform couponing into a fun and rewarding money-saving activity.

Simplifying Your Commute

Simplifying your commute can save you both time and money. Consider alternative transportation options like biking or carpooling to reduce fuel costs and minimize wear on your vehicle. Public transit can also be a budget-friendly choice, offering stress-free travel without the hassle of traffic.

Plan your routes efficiently to avoid delays and maximize productivity during your commute. With thoughtful planning, you can transform your daily travel into a more enjoyable and cost-effective experience, allowing you to reclaim valuable time for yourself.

Saving With Subscription Services

Subscription services can be a fantastic way to save money while enjoying your favorite products and services. From meal kits to streaming platforms, these services often provide discounts compared to traditional retail. Assess which subscriptions truly add value to your life.

Consider bundling services for added savings or taking advantage of free trials before committing. Be mindful of subscription renewal dates to avoid unexpected charges. You can enjoy entertainment and convenience without overspending by carefully curating your subscriptions.

Smartphone Apps for Budgeting

Smartphone apps make budgeting easier and more accessible than ever. With options like Mint, YNAB, or PocketGuard, you can track your spending, set financial goals, and gain insights into your habits — all from the palm of your hand. These apps often provide reminders for upcoming bills and spending alerts.

Explore features that allow you to categorize expenses, helping you identify areas for improvement. With the right app, budgeting becomes less of a chore and more of a manageable daily routine. Take control of your finances with technology on your side.

Plan Ahead for Discounts

Planning for discounts can unlock amazing savings. Start by watching seasonal sales and clearance events for items you need. Creating a shopping calendar helps you anticipate the best buying times, maximizing your savings potential.

Don’t forget to sign up for newsletters from your favorite retailers, as many offer exclusive discounts to subscribers. Use price comparison websites to ensure you’re getting the best deal available. With proactive planning, you’ll score significant discounts and make your budget stretch further!

Family Fun on a Budget

Enjoying quality family time doesn’t have to be costly. Explore local parks, museums, or community events that often offer free or low-cost activities. Organize home game nights or movie marathons to create memorable experiences without breaking the bank.

Consider seasonal activities like picnics or nature hikes, which provide opportunities for bonding and fun. With a little creativity, you can plan exciting adventures that bring your family together while keeping your budget intact. Family fun is all about the moments, not the price tag.

Finding Free Entertainment

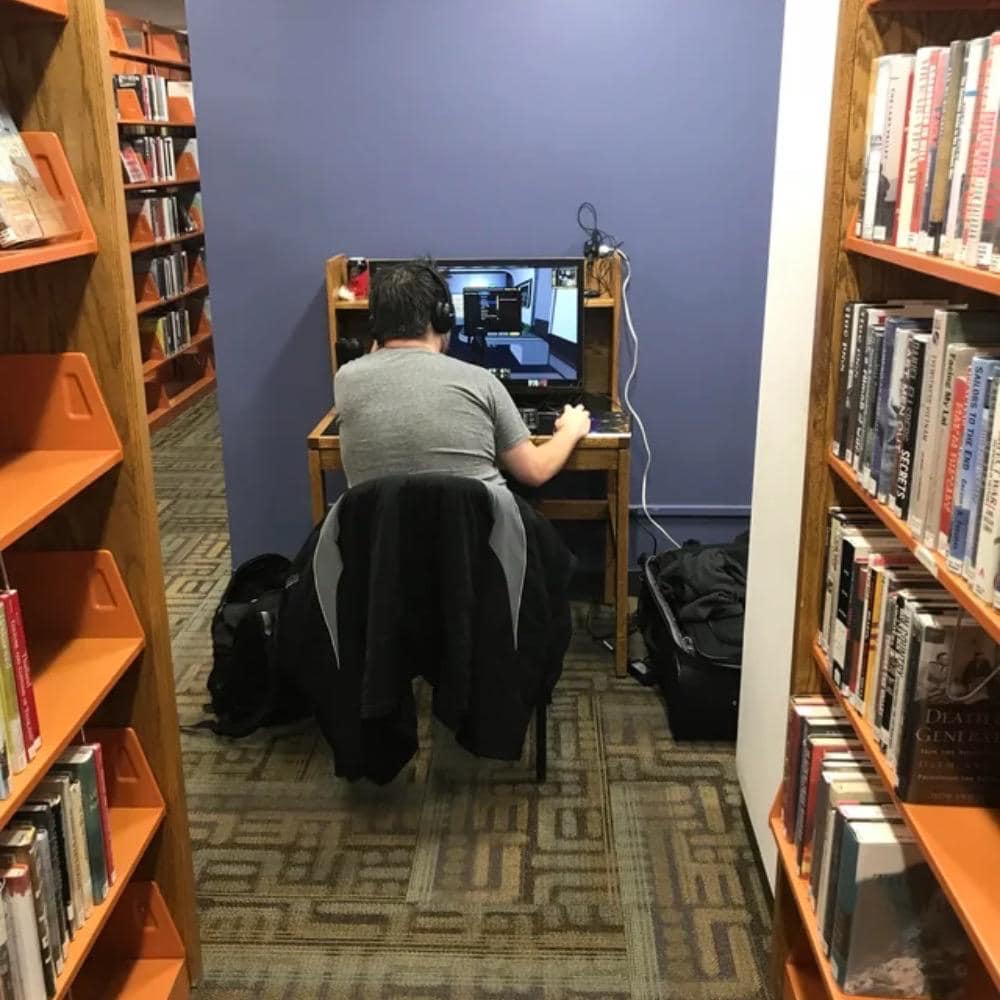

Finding free entertainment can turn boredom into creativity. Start by exploring local events, such as free concerts, festivals, or art exhibitions, often hosted by community organizations. Libraries are also a treasure trove of resources, offering free workshops, movie nights, and book clubs.

Look for nature trails or parks in your area, perfect for hiking, picnicking, or simply enjoying the outdoors. With a bit of exploration, you’ll discover countless ways to enjoy life without spending a dime. Free entertainment can lead to unforgettable experiences and cherished memories.

Online Learning for Less

Online learning provides an affordable way to expand your knowledge and skills. Platforms like Coursera, Udemy, and Khan Academy offer a variety of courses at minimal or no cost. You can learn independently and explore diverse subjects, from coding to art history.

Many universities also offer free online courses, allowing you to experience quality education without the hefty tuition fees. Investing in online learning opens doors to new opportunities while saving you time and money. Embrace lifelong learning and grow your skillset on a budget.

Buying in Bulk Savings

Buying in bulk can be a smart strategy for saving money on everyday items. Many stores offer discounts for purchasing larger quantities, especially on non-perishables like pasta, canned goods, or toiletries. This not only saves money but also reduces the frequency of shopping trips.

However, assess your storage space and consumption habits before diving into bulk purchases. With some planning, you can stock up on essentials, avoid waste, and enjoy significant savings. Bulk buying can be a budget-friendly game-changer for savvy shoppers.

Best Time to Shop

Timing your shopping can significantly impact your savings! Retailers often have seasonal sales, making planning your purchases around major holidays and clearance events beneficial. For example, buy winter clothing for steep discounts at the end of the season.

Additionally, consider shopping during weekdays or early in the morning to avoid crowds and snag the best deals. By staying aware of optimal shopping times, you’ll maximize your savings and find the best products at the best prices.

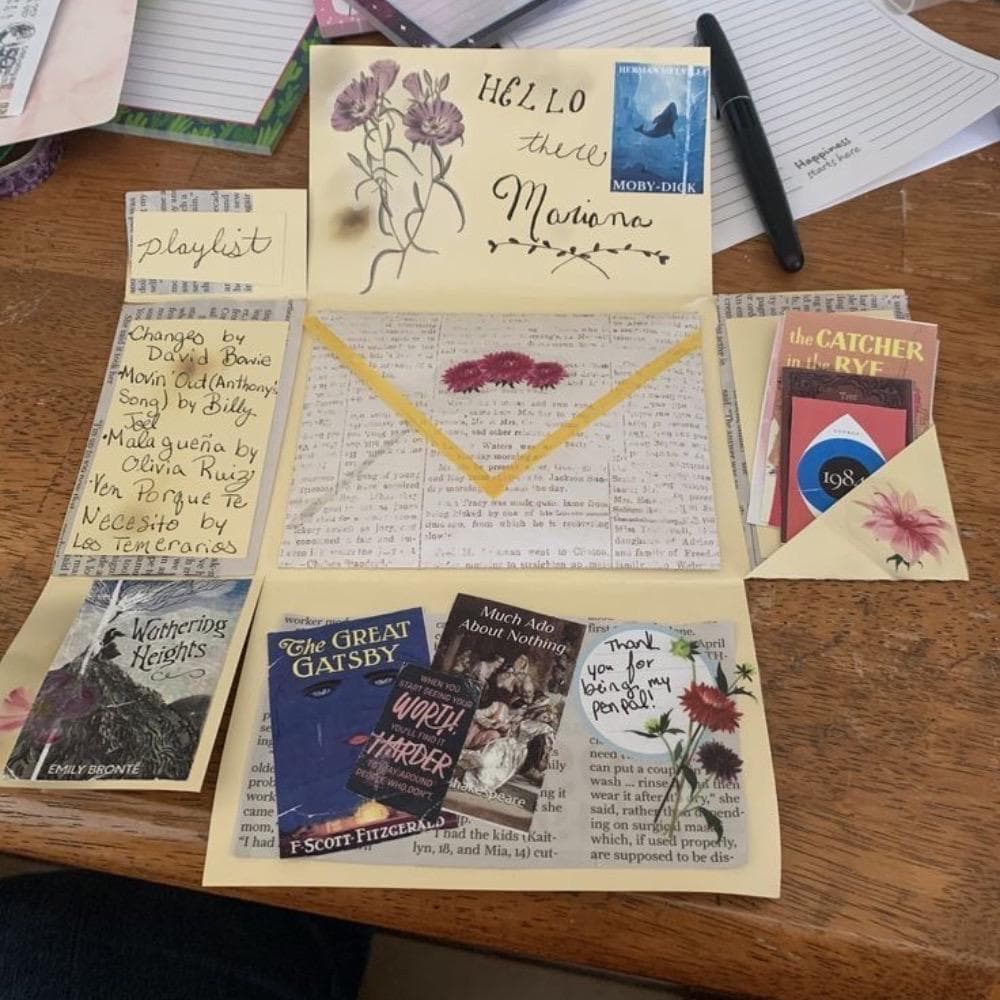

Creative Ways to Save on Gifts

Finding creative ways to save on gifts can stretch your budget without sacrificing thoughtfulness. Consider DIY gifts, such as homemade treats or personalized crafts, that show you care. Handmade items often carry more sentimental value and cost less than store-bought alternatives.

Group gifting can also be an excellent way to celebrate without overspending. Collaborate with friends or family to purchase one meaningful gift for a loved one. You can give memorable presents with a little ingenuity while keeping your finances intact.

Budget-Friendly Home Organization

Budget-friendly home organization transforms chaos into calm without emptying your wallet. Start by repurposing items you already have — use jars for storage or old crates as shelves. Thrift stores can also be treasure troves for affordable bins and organizers.

Use vertical space to maximize storage, like hanging hooks or wall-mounted shelves. Create a system that works for you, whether color-coding or labeling. A well-organized home looks great and makes daily life more efficient. With these tips, you’ll create a tidy haven without breaking the bank.

Managing Multiple Accounts

Managing multiple accounts can be overwhelming, but with the right strategies, you can stay organized. Start by consolidating accounts where possible, such as transferring funds to one primary checking account to streamline your finances. This reduces confusion and simplifies tracking.

Use budgeting apps to monitor all accounts in one place, making it easy to see your financial picture at a glance. Setting up alerts for important transactions or minimum balances helps avoid fees. With careful management, juggling multiple accounts becomes effortless and stress-free.

The Power of Minimalism

Embracing minimalism can lead to a more fulfilling and financially savvy lifestyle. Focusing on what truly matters can declutter your space and mind, ultimately reducing expenses. Start by evaluating your possessions — keep only items that bring joy or serve a purpose.

Minimalism also encourages intentional spending, allowing you to prioritize experiences over material goods. You’ll discover greater clarity and freedom as you simplify your life, leading to a more enriched existence.

Using Library Resources

Your local library is a treasure trove of free resources waiting to be explored! Beyond just books, libraries offer access to e-books, audiobooks, online courses, and community events. These offerings can enrich your life while keeping your budget intact.

Many libraries also provide free workshops, technology classes, and entertainment options like movie nights. Using library resources, you can foster a love for learning and culture without spending a dime. Dive into your local library and unlock a world of possibilities.

Affordable Fitness Solutions

Staying fit doesn’t have to come with a hefty price tag. Affordable fitness solutions can be found in various forms, from outdoor workouts to home exercise routines. Consider using free online classes or workout apps that provide guided sessions without the gym membership fees.

Community centers and local parks often offer low-cost fitness classes or sports leagues, providing social interaction and exercise. With creativity and resourcefulness, you can maintain a healthy lifestyle while keeping your budget in check.

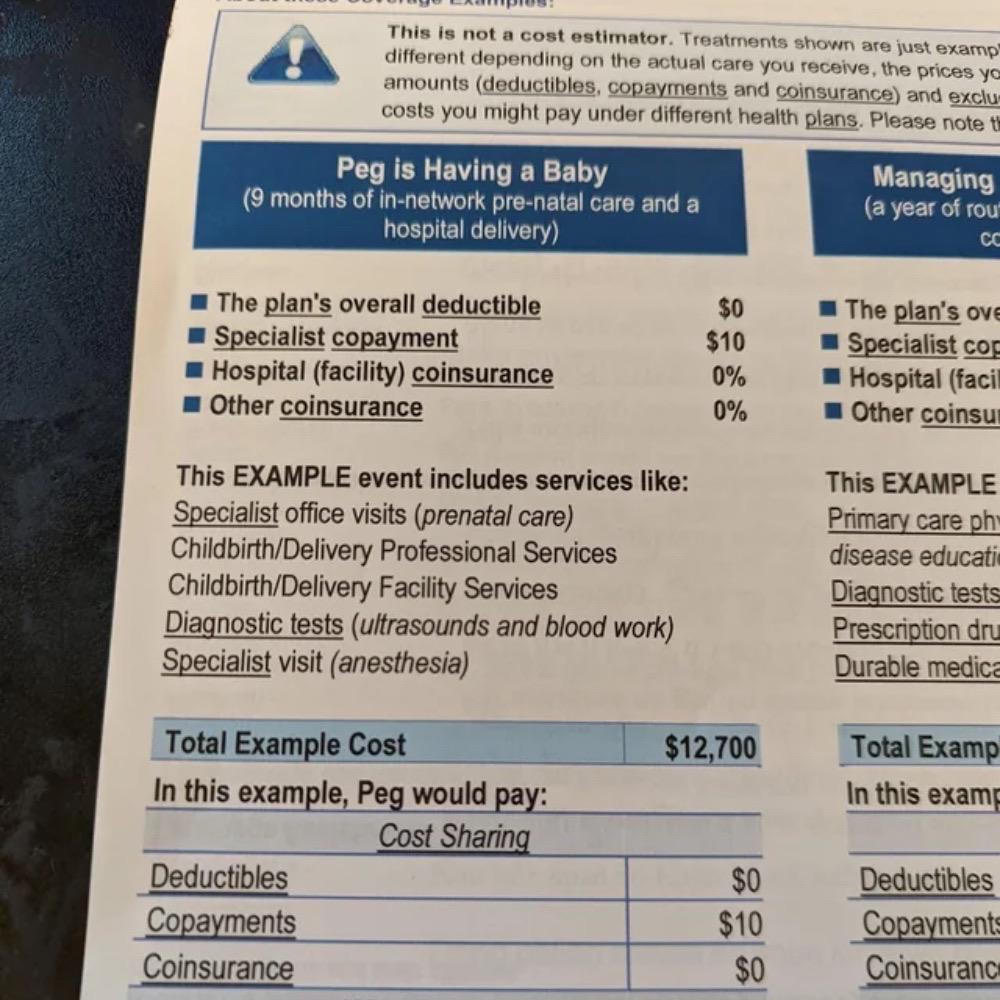

Switching Insurance Providers

Switching insurance providers can lead to significant savings. Review your current policies — identify areas where you might be overpaying. Comparing quotes from multiple companies lets you see where better deals are available, ensuring you’re not missing out on savings.

Consider bundling services, such as auto and home insurance, for additional discounts when switching. Remember to read customer reviews and ensure the provider offers excellent service. By exploring your options, you’ll find a policy that better fits your needs and budget.

Time Management Techniques

Mastering time management techniques can lead to increased productivity and reduced stress. Start by prioritizing tasks using the Eisenhower Matrix, which categorizes tasks based on urgency and importance. This helps you focus on what truly matters.

Another effective method is time blocking, which involves allocating specific chunks of time for different activities and minimizing distractions. Regularly reviewing your progress enables you to adjust your approach as needed. With these techniques, you’ll reclaim control over your time and achieve your goals more efficiently.

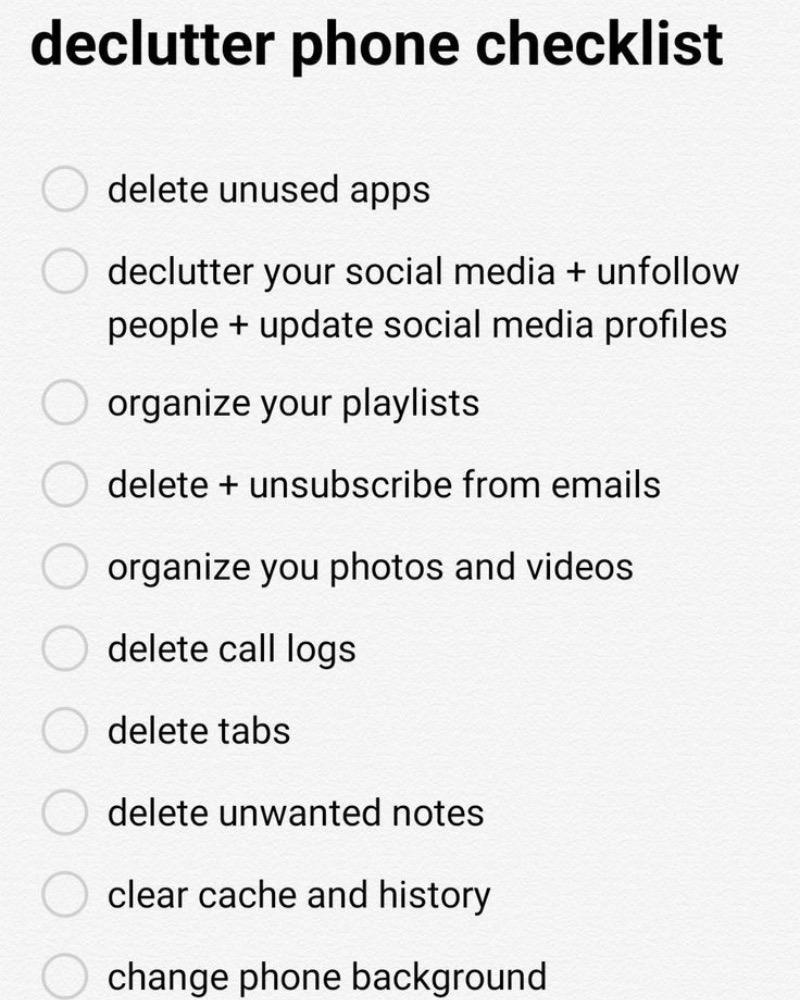

Digital Decluttering Strategies

Digital decluttering is just as essential as organizing your physical space. Start by reviewing files and apps on your devices — delete anything unnecessary to create a cleaner digital environment. Consider using cloud storage for important documents, keeping your devices clutter-free.

Organize your digital files into folders for easy access and regular maintenance. Unsubscribe from unwanted emails to reduce inbox chaos. With these digital decluttering strategies, you’ll enhance your productivity and create a more streamlined online experience.

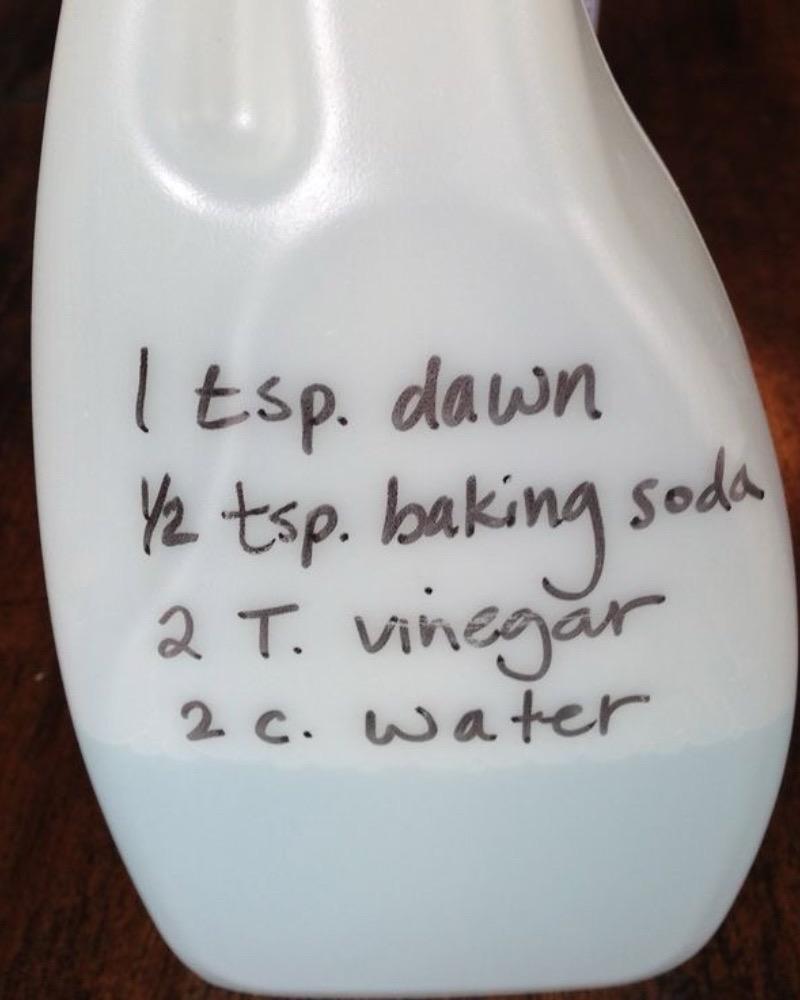

Homemade Cleaning Products

Homemade cleaning products are not only eco-friendly but also budget-friendly. You can create effective cleaners for every corner of your home with simple ingredients like vinegar, baking soda, and essential oils. These natural solutions reduce chemical exposure while saving you money.

Mix vinegar and water for a multi-surface cleaner or baking soda for a powerful scrub. Homemade products are safer for your family and offer an easy way to maintain a clean and healthy living space without overspending.

Easy At-Home Workouts

Easy at-home workouts can keep you fit without a gym membership. Start by exploring online platforms offering free workout videos, from yoga to HIIT, allowing you to exercise at your convenience. Invest in basic equipment like resistance bands or dumbbells to enhance your routines.

Create a designated workout space to boost motivation, even if it’s just a corner of your living room. Whether you prefer following along with an instructor or creating your routine, at-home workouts save time and money while helping you stay active and healthy.

Smart Investing Basics

Understanding smart investing basics is key to building wealth. Start by educating yourself on various investment options — stocks, bonds, mutual funds, and real estate all offer unique benefits. Diversifying your portfolio can mitigate risk while maximizing potential returns.

Consider setting clear financial goals to guide your investment strategy. Don’t hesitate to consult financial advisors for expert advice tailored to your situation. By learning about investing, you can make informed decisions that set you on the path to financial success!

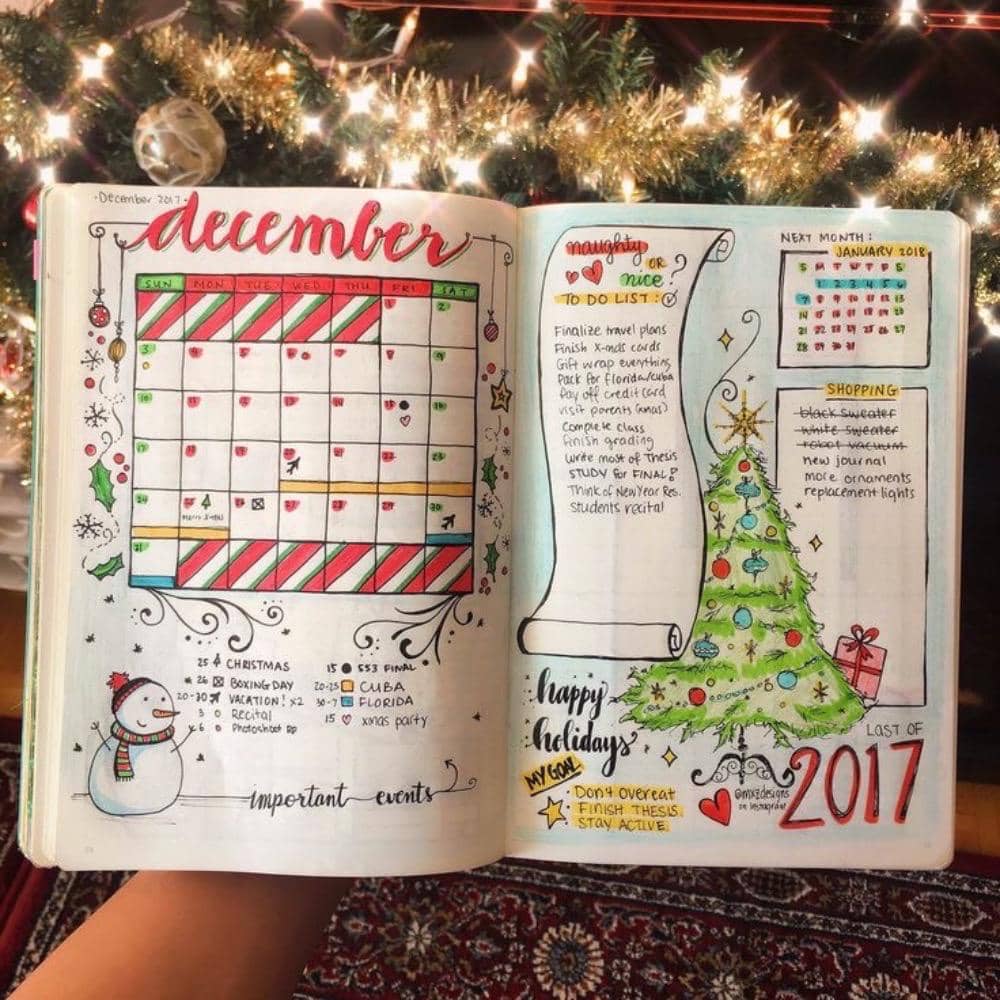

Frugal Holiday Planning

Frugal holiday planning allows you to celebrate without breaking the bank. Start by setting a realistic budget and prioritizing your spending on meaningful experiences and gifts. Consider homemade gifts or thoughtful gestures that convey love without the hefty price tag.

Planning group activities or potluck dinners can reduce costs while fostering connections with family and friends. With a little creativity and intentionality, you can enjoy the holiday season fully while sticking to your budget.

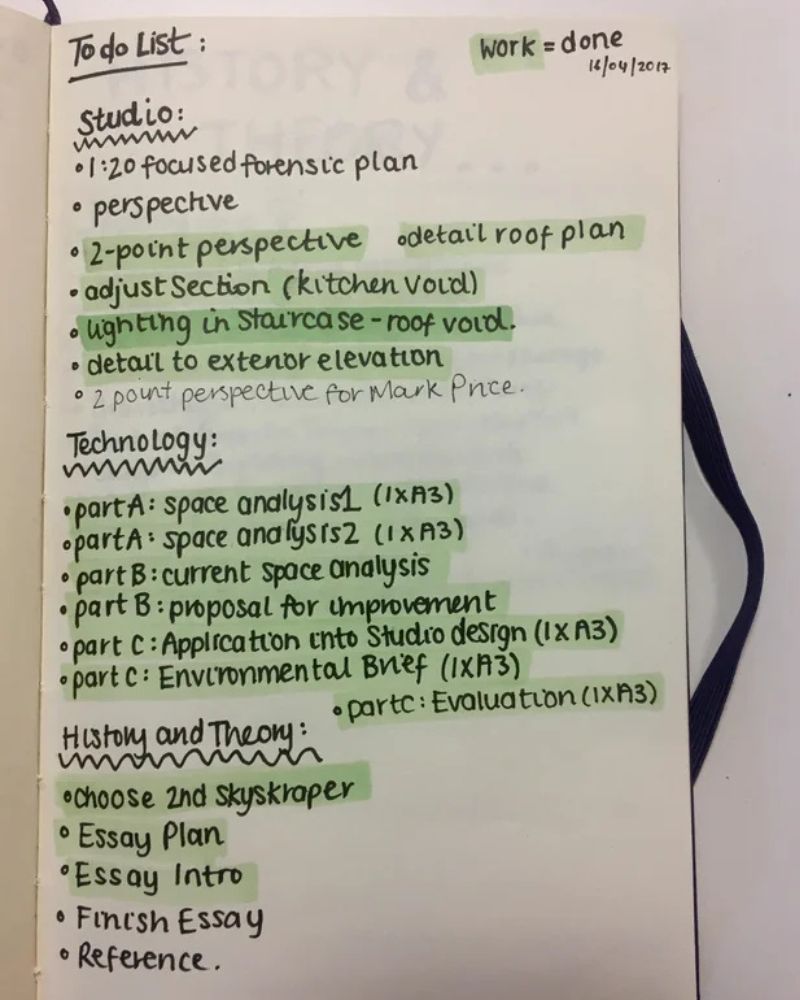

Streamlining Your To-Do List

Streamlining your to-do list can enhance your productivity and reduce overwhelm. Start by categorizing tasks into urgent and non-urgent items and prioritizing what needs immediate attention. Break larger tasks into smaller, manageable steps to make progress feel more attainable.

Consider using digital tools or apps to keep your list organized and easily accessible. Regularly reviewing and updating your to-do list allows you to stay focused and adjust your priorities.

In today’s fast-paced world, saving time and money is more important than ever. Fortunately, there are countless hacks that can streamline your daily tasks while keeping your budget intact. This article will explore some of the most effective time-saving hacks you might not have considered. Trust us, you won’t believe how much you’ve been missing out — especially when you see #17!